Persistent Memory Enables Widespread AI

Image Source: whiteMocca/Shutterstock.com

By Adam Kimmel for Mouser Electronics

Published October 22, 2020

The Internet of Things (IoT) has moved into the mainstream and is poised to connect nearly 42 billion devices by 2025, according to the International Data Corporation (IDC). IoT-connected devices will generate up to 80 zettabytes of data, a 480 percent increase from 2019. The exponential growth and massive data quantity described by these projections highlight the need for a different kind of memory structure. The data must be collected, analyzed, transmitted, and ultimately stored at a scale that technology has never seen. The scale of these functions creates opportunities for innovation in data processing, and the race is on to construct the most optimal solution.

Dynamic Random Access Memory (DRAM) is a popular semiconductor memory technology to optimize or improve processing time and access to stored media. The system provides data storage cells a new charge periodically to mitigate capacitor charge inefficiency. DRAM has become best-in-class for electronics memory and critical to artificial intelligence (AI) because of the continual updating of the data. The challenge has become persistent memory’s cost, with the market share dominated by three principal suppliers and its complicated manufacturing process.

Enter Persistent Memory

Architects and developers designed persistent memory as an affordable alternative to DRAM for servers dedicated to AI processing. Persistent memory delivers huge capacity and supports demanding workloads and emerging tools, such as In-Memory Databases (IMDB). With the emergence of persistent memory data processing, manufacturers are moving to consolidate significant infrastructure. Greater amounts of memory enable workload consolidation to concentrate on fewer nodes. This shift reduces deployments and maximizes processors previously operating below capacity because of memory constraints.

In addition to infrastructure consolidation, persistent memory equips virtualization services with added capacity. This feature creates a cost-effective yet higher level of memory that increases the number of virtual machines (VMs) for a given piece of hardware while increasing the number of operations performed per second. Unlocking additional capacity allows persistent memory to expand the overall system memory capacity accessible by the operating system. The higher level of memory expedites database access and processing.

Although developers created persistent memory to serve as an alternative to DRAM-only hardware, it integrates seamlessly with DRAM to add application options for system architects. The persistent data writes to the non-volatile layer, while DRAM remains in the volatile tier. The integration enables the persistent memory/DRAM architecture to deliver data persistence, advanced resiliency, and hardware-enhanced encryption to optimize data processing’s security and performance.

Business Case

The persistent memory market mirrors that of DRAM, with revenue valued at $62 billion (USD) in 2019. Mobile (42 percent), server (30 percent), and PC (14 percent) applications dominate the market. The overall DRAM market looks strong, with data projected to continue its exponential increase over the next five years. This trend leads to a steady revenue increase and a healthy compound annual growth rate (CAGR) projection for the primary suppliers.

Market Drivers

One of the primary drivers to persistent memory expansion is adopting advanced semiconductor technology in different computing devices. Semiconductors are vital to the IoT, and as AI applications increase the complexity and quantity of data generated, they will need processing solutions that can handle the innovations.

Additionally, the need for higher-grade storage for efficient information management is driving the persistent memory market. The size of data generated requires rapid access coupled with the efficient removal of the data following the device using it. This condition creates the need for a solution to be secure, resilient, and efficient. Persistent memory fits perfectly into this niche.

Finally, the increased demand for electronic consumer goods in the IoT directly benefits persistent memory. However, the market experienced a downturn in 2019 because of an excess of supply. This surplus resulted from DRAM’s commoditization and users increasing the cycle time they are holding on to smartphones, decreasing sales. The supply overage did compel manufacturers to rationalize capital expenditures to avoid overproduction. Coupled with the global increase to device usage and data production from work-at-home caused by COVID-19, the market has begun to rebound on the back of surging demand.

Market Headwinds

Although simpler than its DRAM counterpart, persistent memory solutions are still complicated to manufacture. DRAM itself has become commoditized, but three main suppliers have had the revenue to capitalize on bringing prices down appropriately: Samsung, SK Hynix, and Micron. This oligopoly creates pricing challenges and respective supply risks in the event one of the three experiences a force majeure, typically an unforeseen event beyond the control of a party to fulfill an obligation. Also, two of the three companies are headquartered in Asia, along with most of the manufacturing sites, centralizing the manufacture of persistent memory to one region of the world. Delays caused by continued lockdowns of geographic areas also pose a risk to order delivery, impacting supply that would add pricing pressure.

Vertical Markets

Smart data centers and infrastructure is the primary vertical for persistent memory. The number of data centers constructed to house the data, both on-site and in the cloud, necessarily increases with higher data-generation rates from the IoT and AI. Persistent memory’s affordability, along with rapid speed, reduces latency and raises speed to provide low-latency access to persistent data.

Another vertical is the emerging trend of smart wearables, projected to be $33 billion (USD) by 2025. Remote Patient Monitoring (RPM) and personal fitness devices have exploded in the past few years, led by Apple, Fitbit, and Samsung. Wearables typically extend the smartphone application, creating the need for additional memory and seamless data transfer. Particularly with RPM, achieving low latency is a vital performance metric to provide medical staff real-time information. Persistent memory serves this emerging market well with latency similar to DRAM while maintaining access to critical data.

Product Solution: Intel Optane™ DC Persistent Memory

The vertical markets and risk caused by the current DRAM supply base position persistent memory for the proliferation of the IoT and AI. The Intel Optane™ DC Persistent Memory solution leads innovation in this space, leveraging new applications focused on restart and replication. It significantly and reliably expands memory capacity and performance to achieve the fastest-possible data processing operations at a more manageable cost than its DRAM predecessors.

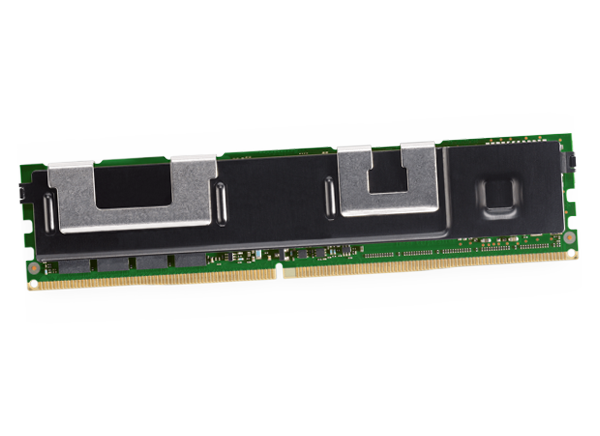

Figure 1: Intel Optane™ DC Persistent Memory accelerates the IT transformation for artificial intelligence by performing 13.7M input/output operations per second. (Source: Mouser Electronics)

Intel Optane™ DC Persistent Memory accelerates the IT transformation for AI by performing 13.7M input/output operations per second. It also offers 36 percent more VMs per node at a cost 30 percent below a DRAM-alone architecture. Persistent memory reduces the total cost of ownership (TCO) by improving the existing hardware packaging envelope’s utilization. Furthermore, augmenting the existing DRAM with persistent memory offers the application owner flexibility to absorb peak-time demand while maintaining the workload memory that the system design specified.

Conclusion

AI is no longer a long-range planning goal or research project; along with the IoT and Industry 4.0, it is disrupting nearly every industry, certainly each one that touches technology. Each new application yields a new frontier with different needs for data processing. Consumer demand for fast, reliable, secure, cost-effective products squeezes existing markets while forming new ones, creating opportunities for disruptive innovation. Intel Optane™ DC Persistent Memory meets all those criteria, increasing memory while protecting access to data. It allows more VMs for less cost, faster speeds, and lower latency with higher resiliency. Persistent memory is enabling AI, and the Intel Optane™ DC Persistent Memory solution is leading the way.