LED Lighting in Home Automation: Ready, Aim, ...

Examples of commercial home automation equipment date back to at least 1975 with the launch of Pico Electronics’ X10 project in Scotland. Although engineers of the day could not have imagined many of today’s implementation technologies, the architectures and use models that they did imagine inform system designs to this day.

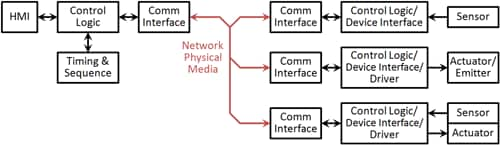

A generic architecture, shown in figure 1, includes a control system comprising a Human-Machine Interface (HMI), control logic, timing and sequencing hardware, and a communication interface serving as the head end of a point-to-multipoint network. Individual client devices implement a communication interface, control logic, one or more device interfaces which, in the case of output channels, include necessary electric drivers.

Figure 1: A generic architecture for home automation can support a broad range of functions including but not limited to security, HVAC control, and lighting.

Among the first applications for early home-automation systems were lighting and appliance controls, both of which home-automation providers implemented as simple on-off mains-power switches. Conveniently for installation, the network physical media was the power line as well, operating with high-speed bursts during the AC zero crossings and communicating one bit per crossing. Accounting for communication overhead and message duplication built into the protocol, early systems realized a communication rate of about 20 baud.

With 12-bit control messages (8-bit address and 4-bit command), latencies for simple commands in the 600 to 750 ms range could be said to have pushed the limits of good taste… or market tolerance. Beyond that, the challenges to power-line communication are legend and the reliability of home-automation systems fell short of market expectations for many years. Though the idea remained compelling for a small but fiercely loyal user base, home automation seemed destined to fail in the mass market until technology caught up with the concept.

… Then Technology Caught Up

Today, home-automation systems are enjoying resurgence and, for the first time in their four-decade history, appear poised for broad-market adoption. As many have seen in other segments, this turn derives from a confluence of several technology advances, none necessarily driven by home-automation applications per se, but which combine to serve such uses far better than any set of technologies previously available for the purpose. For residential lighting in the context of home automation, three specific areas of technological innovation have contributed to making systems more attractive to the broad residential market: Communication, control, and the lighting devices themselves.

At the heart of many home-automation implementations is a wireless network, which solves many of the problems suffered by power-line communication schemes including difficulty communicating across phases of split 240/120-V systems, adjacent-dwelling interference, and glacial data rates. Currently, wireless devices conforming to IEEE 802.15.4 are most common, particularly those conforming to ZigBee Alliance specifications popular in IoT applications.

ZigBee provides 250 kpbs data rates in the 2.4 GHz ISM band; lower rates to 20 kbps in geo-specific sub-GHz spectrum. Unlike WiFi, which forms star networks extendible only by adding dedicated hardware repeaters, ZigBee nodes form mesh networks, which extend automatically with each additional node. Mesh networks can also alter message routing to mitigate spurious RF interference, making the scheme more robust than are those based on star arrangements.

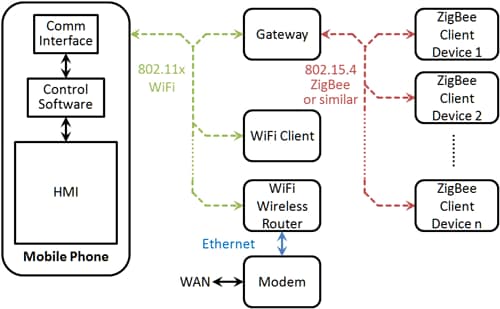

Dedicated home-automation control hardware has given way to software applications that run on the universal wireless HMI device—the mobile phone. Gateway hardware solves the connectivity problem created by mobiles’ lack of compatible radios and serves as the bidirectional interface between the 802.15.4 Zigbee wireless home-automation network and nearly ubiquitous 802.11x WiFi data communication LANs, as shown in figure 2.

Figure 2: Modern home-automation systems replace central control hardware with application software that runs on a smart phone. A gateway bridges the WiFi connected phone to the automation system’s 802.15.4 mesh network.

Because the HMI and system-control functions are not always present, timing, sequencing, and grouping functions must reside within the individual client devices. Moving these functions to the client devices also provides for multiple HMI interfaces to coexist on the same network through a single gateway, allowing anyone in the household with network access to control devices as they choose. Basic setups such as lighting groupings and scenes reside within the light controls, as figure 3 depicts.

Figure 3: Current home-automation schemes must operate in the absence of a central controlling device. Client devices such as smart dimmers manage functions such as timing, sequence, groupings, and scenes (A). For lamps not hardwired to dimmers, smart bulbs include all of the necessary functions to operate as freestanding nodes (B).

Commercial Leads the Way

Automation for lighting control has been enjoying broad market acceptance in the commercial sector since high-color-quality LED light bars and replacements for fluorescent tubes have become available. This success has helped inform designs for residential applications. The two sectors present key differences, however, so it is important not to draw out the comparison too far.

Fluorescent fixtures have long dominated commercial lighting where their diffuse light output, high color temperature, and efficiency have provided benefits in office spaces where lighting installations can cover floor space seemingly by the acre. Commercial applications also exploit traditional incandescent or halogen devices in down lights, sconces, and track lighting to provide pool or focused lighting for various visual effects, primarily in retail areas, building office lobbies, and conference rooms.

Historically, simple switches controlled fluorescent lighting troffers. Lighting for large cubical-farms might switch troffers in clusters or wire multi-tube devices with each tube position ganged to a separate circuit, allowing stepwise dimming by switching off one or more tubes in each troffer. Overall, however, traditional fluorescent lighting devices did not invite control by dimmers and systems rarely included occupancy detection. An estimated 40% of commercial electric energy use is attributable to lighting, however, and the commercial sector has long been eager for lower-cost alternatives. LED lighting and new lighting-controls are allowing companies to realize cost reductions in excess of those that simple lumen-per-watt comparisons suggest.

In residential lighting, incandescent bulbs compatible with standard threaded Edison sockets, such as A, BR, and PAR series bulbs, dominate. These are found in ceiling-mounted down lights, track fixtures, tabletop and floor lamps, sconce fixtures, and pole-mounted lamps for outdoor applications. Fluorescent tubes account for a tiny fraction of residential lighting, notably in garage or basement shop areas, laundry rooms, and as under-cabinet task lights in kitchens. Even these few uses, however, have increasingly given way to alternatives.

Dimming, Enlightened

Automated or not, a traditional dimmer blanks its output during the leading portion of each half power cycle and, once activated, remains on until a power-line zero crossing. Incandescent light bulbs—roughly 98% efficient as heaters, are in effect thermal low-pass filters with long time constants relative to the line-power period.

An LED, by contrast, is essentially an electrons-in-photons-out DC current-driven device. LEDs are not natively compatible with AC voltage sources and traditional dimmers that chop up the AC voltage waveform only compound the incompatibility.

LED ballasts provide the fundamental rectification and V-I conversion necessary to operate from AC voltage sources and, in dimmable devices, essentially map the duty cycle onto an output current range.

Dimmers from only a few years ago provided limited range for dimmable LED bulbs—typically only about 7 dB. They also often exhibited visible flicker when operated at or near their lowest settings. These issues, unfortunately, created uncertainty in the residential market in part because different combinations of bulb and control produced different results.

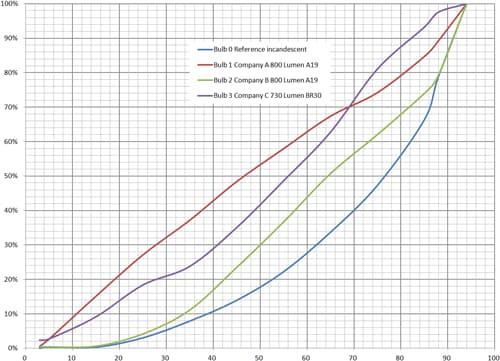

Current designs seem to have resolved those issues. In its recent Solid-State Lighting Spot Check, JAS Technical Media measured the illumination produced by various LED bulbs operating on a number of dimmers, using an incandescent bulb as reference. Data from one trial, typical of the spot check’s overall results, appear in Figure 4 & 5. The plots normalize each bulb’s dimming curve to its own output with the dimmer bypassed. The graph’s horizontal axis is the power dissipation of a 100-W incandescent bulb reference, measured with the dimmer bypassed and at each test point along the dimmer’s travel.

Figure 4: Unlike those of just a few years ago, current LED bulb and dimmer designs produce smooth dimming with no flicker or audible noise at low levels. (Figure courtesy JAS Technical Media; used by permission.)

Figure 5: Compared to a reference incandescent bulb (left column), some companies’ LED bulbs exhibit indistinguishable dimmer waveforms (center column), whereas others alter the dimmer waveform (right column). Explanations for the differences were not available in time for this article. The oscillographs represent waveforms with the dimmer fully on (top row), at 75% power (ref incandescent power), 50%, 25%, and at the dimmer’s lowest setting (bottom row). (Figure courtesy JAS Technical Media; used by permission.)

Better Bulbs

Sales of early generation LED light bulbs for residential service were sluggish for several reasons. Bulbs were available only in “daylight” (5000°K) color temperature, which many see as unduly harsh for indoor residential lighting. Bulbs were only available with one or two options of lumen output.

Pricing for early generation bulbs—typically $25 to $50—produced sufficient sticker shock to keep many homeowners on the sidelines. For those who caught their breath and mustered sufficient curiosity to do the math, the annualized savings for bulbs plus electricity was somewhat less than compelling.

The market log jam broke a couple of years ago when Cree marketed 2700 K, 900 lumen bulbs for under $10 with street prices in the area of $8.50 in some home-improvement stores. Since then, LED bulbs have become available at reasonable cost in a wider range of lumen ratings and bulb shapes, making the technology more attractive to the full range of residential lighting applications. Additionally, bulb manufacturers are in the process of sun-setting (retiring) most incandescent products and the fragility and mercury content of CFLs, which present a disposal challenge to the homeowner, have made LED bulbs preferable to a growing segment of the residential market.

More recently, Osram Sylvania released a series of smart bulbs that integrate an 802.15.4 radio, processor, dimmable current drive, and the LEDs in standard A19 envelopes. These bulbs are compatible with Osram Sylvania’s gateway, allowing grouping, scene programming, and dimming without wall dimmers. Smart bulbs take a hefty premium at the cash register, but if you factor in the cost of a smart dimmer and the greater-than 11 year projected bulb life, they may be attractive, particularly for homeowners that do not want to get involved with installing new smart dimmers.

Where home-automation might truly shine in residential lighting is in lighting arrangements not possible by other means. For example, in conjunction with automated controls, color-tunable LED lamps can produce a range of effects. On the fanciful end of that spectrum, one can set the color of, say, accent lighting in a living room to a deep blue to create an ambience reminiscent of a theatre for movie night or shift the light color in a dining room toward red for a romantic dinner. More pragmatic, home-automation systems can program lights in a bedroom to fade up in time for waking with color to match a sunrise culminating, if desired, with the high color temperature of a cloudless sky. Although such systems remain untested in clinical settings, they may be particularly attractive to people in northern latitudes who suffer from seasonal affective disorder by simulating daylight—something incandescent bulbs cannot do.

Ready, Aim, …

… watch your feet. A good number of home automation systems have entered the market in the last year or so. Most market home-security and HVAC-management as primary applications with window and door sensors, doorbell pushbuttons and low frame-rate security cameras, and thermostats as leading networked devices. All support lighting but, in many cases, lighting-control nodes require more complex installation than do other types of networked device, so few displays lead with that application.

Although there is more than enough good home-automation technology readily available, other factors may stunt residential-market adoption rates in the near term. Key among them is interoperability, or the lack thereof, particularly for nodes and application software from different providers.

Right now, the home-automation market could be poised for a Betamax-vs-VHS-style battle multiplied by three or four. As in that oft-referenced marketplace battle, it is unlikely that the winner(s) and losers will emerge on technical merits. Indeed, Betamax was, on technical grounds, the superior format but matters of cost, convenience, and available titles launched it right into the footnotes of home-entertainment history along with quadraphonic audio.

Since then, the consumer market has come to expect interoperability among technology products supporting a given application. Here, WiFi equipment serves as a good comparison. You can buy a wireless router from Netgear, a range-extender from Linksys, a printer from HP, and a camera from Canon and not care who makes WiFi silicon for any of those devices, not to mention your laptop, pad computer, or mobile phone. Interoperability is a given.

If present at all, interoperability is far from obvious in the home automation market. Vendors’ marketing-collateral materials are essentially mum on the topic. So it appears that if you buy a gateway for one branded system, you are locked into that brand for all of your networked nodes and for your application software. Although technology aplenty is readily available, clouds on the horizon could be those of a coming market shakeout.

On the other hand, if home-automation vendors move toward interoperable systems, homeowners can choose the HMI software that best suits their preferences, gateways that best fit their budget and network requirements, and individual nodes that best serve their application needs.

Additionally, although several companies have already staked out home-automation, the market is far from mature and there is plenty of opportunity and technical support for an upstart to jump in. A few examples include silicon vendors like Analog Devices that offer sensors and low-power sensor front ends for temperature or humidity measurement, and smoke or proximity detection nodes. The company also offers IEEE-802.15.4-compliant transceivers for the global 2.4-GHz band and for geo-specific sub-GHz bands as well as a host of analog and mixed-signal signal-processing ICs.

Murata offers a line of micro DC-DC converters built on ferrite substrates, which embed the power inductor and input and output capacitors for a simple drop-in power subsystem in 6 to 28mm2, depending on function and maximum load current. The company also offers IEEE-802.11-b/g/n-compliant network controller modules that support WPA and WPA2 PSK WiFi protected access and WPS WiFi protected setup and fit in a nominal 30.5 x 19.4mm footprint.

If your application can benefit from embedding individual white LEDs, TE Connectivity offers their line of LUMAWISE LED sockets and holders. Various models are compatible with Cree XLamp, Osram Soleriq, Philips Lumiled, and other available white LED product lines.

Acknowledgement

The author thanks Cree Vice President of Product Strategy Mike Watson and Osram Sylvania Head of Lightify Aaron Ganick for sharing their insights.