How Connected Vehicles Will Safely Leverage Smartphones

Emerging trends highlight the role of the connected vehicle in transportation, but vehicles are poised to become an essential platform for personal mobility. In combination with personal electronics, the connected vehicle will redefine the mobile experience, bringing the separate capabilities of mobile device and vehicle together into a single, safe, personalized environment.

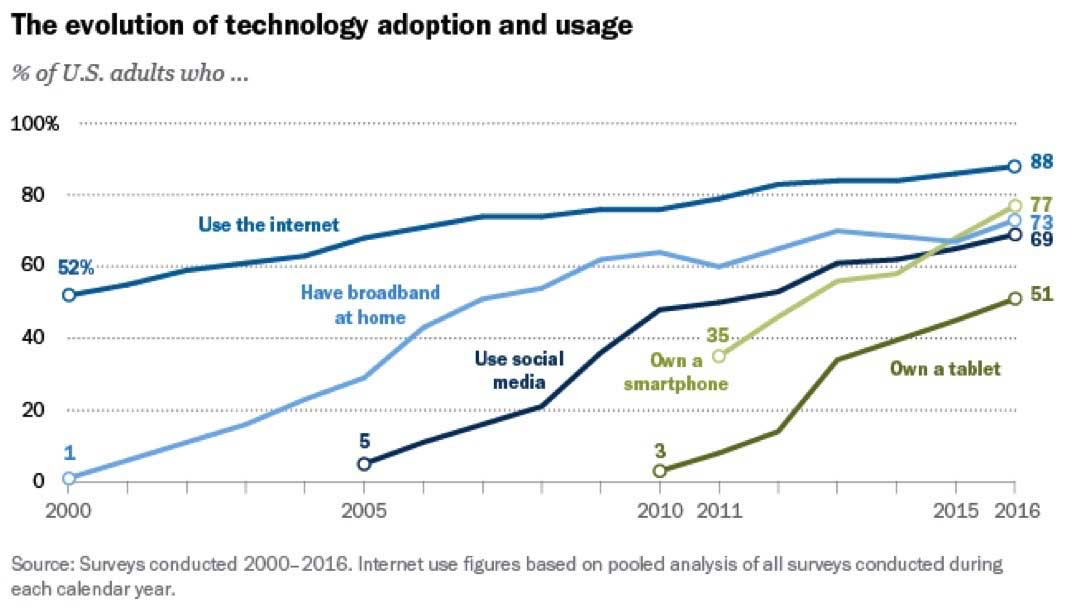

In many ways, smartphones have replaced automobiles as cultural icons, particularly among millennials and post-millennials. Thanks to the diverse capabilities of these devices, smartphone adoption has rapidly accelerated, outpacing many other services and media according to Pew Media (Figure 1).

Figure 1: Users have embraced smartphones, adopting them at a faster rate than other leading communications devices and media. (Source: Pew Research)

Indeed, the smartphone’s impact on individuals’ depth of interaction with the world and society is profound. In the same way, users rely on personal devices such as smart watches and fitness monitors to gain a deeper understanding about their own bodies and their immediate environment. The connected vehicle promises to add to the depth and breadth of resources available to individuals through their personal devices—and enhance the role of smartphones and other mobile devices in users’ interactions with the vehicle itself.

As part of their broad role in daily life, smartphones are already endemic to vehicular transportation. Individuals now rely on smartphone apps for a wide range of services including route planning, navigation, ridesharing, traffic safety, parking information, transportation data management, fuel purchase, and fuel-consumption tracking. Indeed, connected vehicles will build on user familiarity not only with smartphones themselves but also with the simple, intuitive interfaces and interactive paradigms that have evolved with smartphone apps. In doing so, the connected vehicle will play multiple roles as a mobile-device platform in facilitating their use within vehicles, leveraging their accessibility, and even enhancing their capabilities.

Leveraging Smartphones

In the most basic role in working with smartphones, connected vehicles stand to build on an existing relationship with these devices. In-vehicle systems such as Apple CarPlay and Android Auto already provide services that mirror mobile apps on the vehicle’s central display. For users, these systems provide easy access to favorite apps and online services. This relationship continues through manufacturer-provided remote-access apps that allow users to locate and remotely lock or unlock their vehicle.

With their enhanced capabilities, connected vehicle platforms look to offer significant improvements to these services. For example, emerging digital key services such as Volvo’s would let vehicle owners use their smartphones to grant a temporary remote key to another party. In this type of situation, a driver could grant vehicle access to a retail store. In turn, the store could deliver packages to the driver’s parked vehicle, using the one-time digital key to unlock the vehicle, which would automatically relock itself afterwards.

Among desired automotive features, digital key technology ranks highly, particularly among younger consumers, who will grow in buying power as advanced connected-vehicle technologies reach the market. According to the J.D. Power 2017 U.S. Tech Choice survey, post-millennials in particular are willing to pay for digital key features that use a smartphone or watch instead of a physical key or key fob. In fact, the study documents the desire among individuals in this “smartphone generation” to make their smartphone the center of their interaction with the vehicle for control of functions such as infotainment.

Complementary Resources

Some of the most promising opportunities for extending mobile-device functionality lie in the ability of connected vehicles to use their powerful resources to complement these devices for services such as navigation. Many users prefer smartphone navigation apps over in-vehicle navigation systems. In fact, according to the J.D. Power 2016 U.S. Tech Experience Index study, among new owners of vehicles with built-in navigation systems, nearly two-thirds use their smartphone or a portable navigation device rather than the vehicle’s system. Yet, drivers often find gaps in travel directions from their smartphone navigation apps due to GPS dropout from natural obstructions or because their mobile devices lack the radio sensitivity to maintain a lock on weak GPS signals.

Vehicles can take advantage of their size and ready power sources to provide a more sensitive signal-reception platform or complement that platform with advanced inertial measurement unit (IMU) devices able to track location in the absence of GPS signals. Similarly, connected vehicle platforms can offer resources to buffer large data sets such as detailed route maps—both speeding performance and filling in data gaps found in GPS or cell coverage. Just as important, vehicle platforms can support the additional navigation-design complexity required to resist accidental or intentional interference including navigational signal spoofing.

The small size of smartphones meets practical needs for portability but leaves them less effective for user interaction, particularly for vehicles in motion. Besides the difficulty in finding interface features on a small screen, smartphone users can easily be distracted while struggling to touch specific app landing spots in moving vehicles.

Connected vehicle platforms will help minimize these difficulties not only with enhanced graphics for smartphone mirroring, but also with sophisticated gesture-based user interfaces based on specialized semiconductor devices. For example, the Analog Devices ADUX1020 IC integrates a complete optical sensor system for time-of-flight-based proximity and 2-D gesture detection. To support even more complex gesture-based interfaces, the Microchip Technology GestIC family uses a near-field RF approach to support 3-D gesture detection. Instead of requiring users to touch a physical button or screenpad location, interfaces based on these devices will let drivers or passengers simply make specific hand or finger movements to control infotainment or environmental systems, for example (Figure 2).

Figure 2: Advanced devices such as the Microchip Technology GestIC family support advanced 3-D gesture interfaces that can reduce distractions associated with use of small smartphone touch screens. (Source: Microchip)

Besides providing better options for user interaction, connected vehicles can serve as a platform for a richer set of information. Just as wearables offer detailed information about the user’s health and immediate environment, connected vehicle platforms can deliver deep information about the vehicle and the travel route. Using the connected vehicle’s built-in sensor and connectivity services, the connected platform can generate and update highly automated driving (HAD) maps based on a broader set of sources such as vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) services unavailable to the smartphone. By combining data from HAD maps, V2I, V2V, and driver awareness safety systems, advanced platforms could keep drivers updated through their smartphones even while out of the vehicle.

Hardware Foundation

In the interplay between vehicle and mobile devices, connected vehicle platforms will draw on a substantial set of capabilities built into a hardware foundation and tuned to the broader requirements of the automotive environment. Wireless services are fundamental to connected vehicles and these platforms will take advantage of a wide range of connectivity options. Along with specialized protocols such as wireless access in vehicular environments (WAVE) for short-range V2I and V2V communications, the connected vehicle platform will supplement existing Bluetooth options with Wi-Fi connectivity—one of the most anticipated features for mobile device users.

Users can already create in-vehicle Wi-Fi hotspots with their smartphones or dedicated devices attached to vehicle power sources or even to the vehicle’s standard ODB-II port. Without a larger vehicle-integrated antenna system, however, ad hoc Wi-Fi hotspots suffer the same limitations in dealing with weak carrier cellular signals as do smartphone-based navigation applications in dealing with weak GPS signals. Leveraging advanced frequency-agile devices such as the Analog Devices AD9363 RF transceiver, on-board systems can provide reliable connections to carrier services through high-performance antennas built into the vehicle structure.

Within the vehicle, advanced devices combine Bluetooth transceivers with dual-band Wi-Fi supporting 2.4GHz or 5GHz radios. In anticipation of rapid acceptance of in-vehicle Wi-Fi, particularly for video streaming on mobile devices, manufacturers are already looking at performance enhancements such as multiple-input and multiple-output (MIMO) for robust connectivity and real simultaneous dual band (RSDB). RSDB supports simultaneous operation on both 2.4GHz and 5GHz bands, enabling high-throughput connectivity across multiple types of personal devices and Wi-Fi devices built into the vehicle.

Vehicle manufacturers also recognize that increased use of smartphones, tablets, and other mobile devices in vehicles means greater need for recharging those devices. Standard wireless power protocols such as Qi from the Wireless Power Consortium help simplify this aspect of smartphone usage. Rather than dealing with a tangle of different charging cables, drivers and passengers can simply place compatible devices on Qi-compatible charging surfaces built into the vehicle. Embedded into these surfaces, high-efficiency wireless charging coils such as Molex’s PowerLife coils support multiple frequencies, allowing developers greater flexibility in supporting coexistence within the active RF environments expected in advanced vehicles. Driving those coils, Qi-compliant wireless-charging ICs use feedback mechanisms defined in Qi protocols to safely manage device charging.

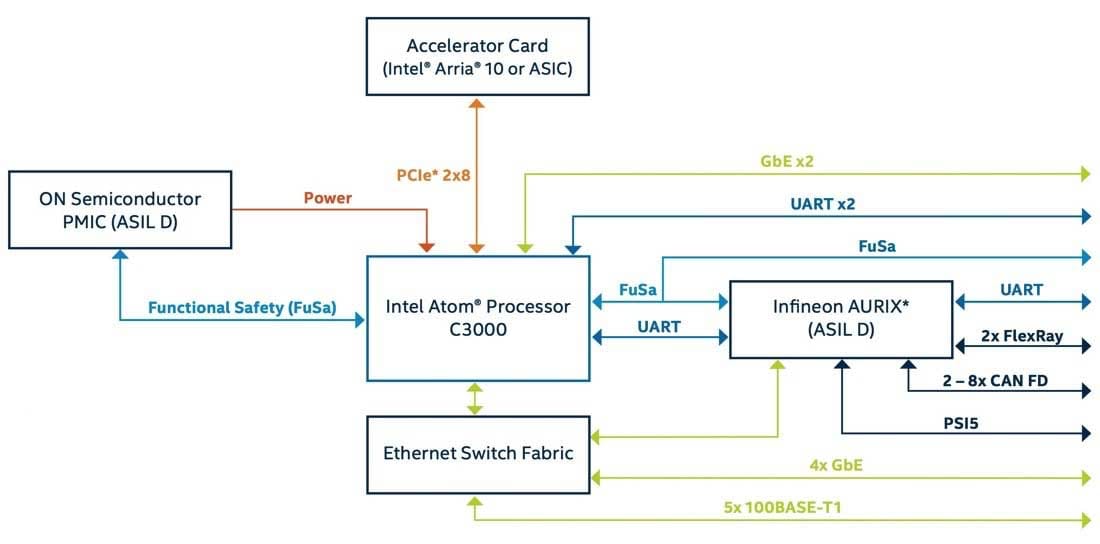

Beyond these individual components and subsystems, reference architectures such as Intel’s GO platform provide the kind of unifying framework required to coordinate diverse hardware systems and software services. Targeting self-driving vehicle applications, the GO platform defines an architecture that combines accelerators based on ASICs for FPGAs with computing resources designed to scale from Intel Atom processors to high-performance Intel Xeon processors plus Arria 10 FPGAs (Figure 3).

Figure 3: Designed for autonomous vehicle designs, reference architectures such as the Intel GO platform provide a technological foundation able to scale from Atom-based systems (shown here) to very high-performance multi-board systems based on Intel Xeon processors. (Source: Intel)

Within this platform, specialized devices provide power and performance features while supporting automotive functional safety requirements in line with Automotive Safety Integrity (ASIL) Level D. Although created for autonomous and semi-autonomous vehicle systems, this type of platform points the way toward next-generation systems that would form the foundation of broader services including integrated support for mobile devices.

Roadblocks to Acceptance

Although hardware and software elements are ready to tighten the synergy between connected vehicles and mobile devices, deployment depends on issues beyond technology. The idea of merging smartphone and vehicle services—and doing it safely—requires a shift in functionality from smartphone to vehicle. Users may find it fundamentally difficult to relax their grip on smartphones—much less pay to do so. According to the J.D. Power 2017 U.S. Tech Choice study, consumers show a greater willingness to pay for safety features such as collision protection and driving assistance than for convenience features such as entertainment and connectivity.

Nonetheless, better integration between smartphones and vehicles helps address a more serious problem—that of distracted driving. Mobile devices combine all the key risk factors for distracted driving in causing drivers to take their eyes off the road, to take at least one hand off the wheel, and to divert their attention from the driving process. Because of the multiple risk factors associated specifically with handheld use, local or regional legislators have enacted laws that prohibit use of handheld devices by vehicle drivers. Connected vehicle platforms can provide options able to address these risk factors—enabling users to safely employ the core features of their smartphones while on the move.

Conclusion

Through application mirroring and remote access functionality, the automotive industry has already hinted at the kind of synergy that is possible between smartphone and vehicle. More advanced connected vehicle platforms promise to extend this relationship with smartphones by providing services that complement the limited resources of smartphones while enabling their safe use within vehicles. For these platforms, advanced semiconductors and platform architectures provide the technological foundation able to support emerging requirements for connected vehicles. At the same time, emergence of smartphone-aware connected vehicle solutions depends as much on cost factors as safety concerns.