CBRS Is The Next Big Thing In Wireless

It’s been years in the making, but the Federal Communications Commission (FCC) finally has something to show for its National Broadband Plan: The Citizens Broadband Radio Service (CBRS). It hasn’t gotten as much attention as 5G and the Internet of Things (IoT), but it’s an important development that should have a wide impact. That is, CBRS will succeed if it works better than previous FCC attempts to alleviate the shortage of frequencies available for wireless communication services.

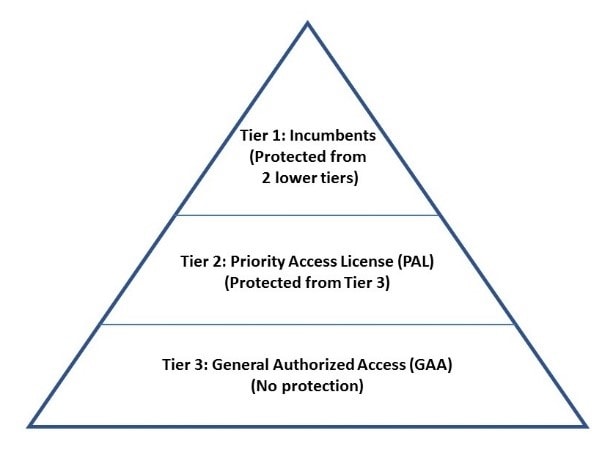

CBRS combines spectrum sharing using a three-tiered hierarchy (Figure 1) with carrier-grade LTE and 150MHz of contiguous spectrum between 3550–3700MHz. If 150MHz doesn’t seem like much, consider that a major wireless carrier uses about 130MHz for all its networks combined. The three-tiered approach means existing Tier-1 services (e.g. U.S. Navy radars and fixed satellite earth stations) have priority over the other two categories, which from highest to lowest priority are Priority Access Licensees (PAL) and General Authorized Access (GAA) users.

Figure 1: The three-tier hierarchy gives Tier-1 incumbents protection from interference by lower-tier users and PAL licensees protection from the GAA users.

The incumbent military radars and satellite ground stations are protected from interference from the lower two tiers, and PAL licensees are protected from the lowest-tier GAA users. The entire system will be managed by a Spectrum Access System (SAS), discussed later in this article.

Why CBRS Is Significant

CBRS is important because it is designed to provide benefits covering many markets and applications. Its primary benefits are:

- Making private LTE wireless networks economically and technically feasible for the first time with performance significantly better than Wi-Fi used today for this purpose.

- Offering the use of spectrum without cost that can be used for many purposes.

- Using the most advanced SAS ever developed, so a requirement for “listen-before-talk” is not required to sense a device’s spectral environment before it starts a transmission.

- Allowing wireless carriers to add coverage and capacity and boost data rates on a licensed or unlicensed basis (or both).

- Providing an alternative for IoT connectivity at the “long-range level” that is currently available almost exclusively by wireless carriers and operators of Low-Power Wide Area Networks (LPWANs).

- Changing the way Distributed Antenna Systems (DAS) are owned and operated by neutral hosts.

- Using existing technologies: LTE (TDD-LTE in particular) is the technology most discussed for use with CBRS, but other technologies and even Wi-Fi could be used if they’re “digital” and comply with FCC rules.

The Fall And Rise Of Spectrum Sharing

It’s no secret that there is not much spectrum available left for the taking at frequencies best suited for wireless communications. It’s either been auctioned off, is “owned” by the US government, or is otherwise encumbered. As a result, the government and the cellular industry are looking for alternatives wherever they can be found, one of which is spectrum sharing that allows two different services to occupy the same frequencies with safeguards against interference.

The cellular industry is also resorting to Carrier Aggregation (CA) that combines two or more small slices of spectrum to produce a larger one that enables higher data rates and capacity to be achieved. In addition to CA, the latest enhancements to LTE are much more spectrally efficient than their predecessors, so more traffic can be accommodated. However, both are only partial solutions to a much larger problem.

It should be noted that while spectrum is available, nearly 60 percent of the entire electromagnetic spectrum in the U.S. from DC to light and more than half of the frequencies (1500MHz) between 300MHz and 3GHz—that is, the “sweet spot” most desirable for radio communications—is owned by the federal government. As much of this spectrum is either used minimally or not at all, logic would dictate that at least some of the spectrum needed by wireless carriers should be pruned from the government. This has historically been practically impossible, as the government, especially the Department of Defense, realizes that the electromagnetic spectrum is a finite resource coveted by commercial users and thus a precious commodity well worth fighting to retain.

Ideally, spectrum sharing produces more capacity without moving incumbent services elsewhere, eliminating the need for these services to perform technically and administratively complex tasks to “set up shop” on new frequencies.

The FCC has attempted spectrum sharing in the past, but the CBRS may be the first development to prevail against technical and industry challenges. An infamous previous attempt that uses the so-called “TV white spaces” made available when over-the-air broadcasting transitioned from analog to digital crashed and burned, except at 600MHz where a few smallish systems are operating. Spectrum sharing was not the only reason that initiative became an embarrassing debacle, but it was a major contributor, and CBRS uses the same basic database-driven approach.

The SAS Is The Key

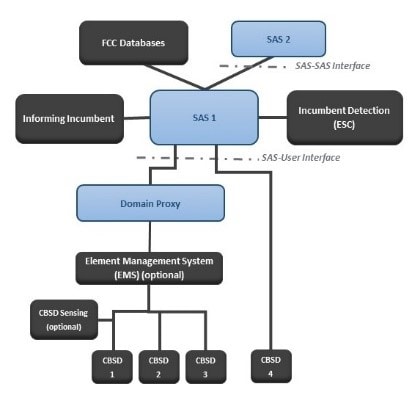

The SAS manages and enforces the shared frequencies and all its users using a cloud-based database of all CBRS devices including their tier, identifying information, location, and other data to coordinate channel assignments and prevent interference (Figure 2). The SAS has an enormous job assigning channels for CBRS devices and determining their maximum power at every location, thus ensuring it is not exceeded. It also registers and authenticates devices, communicates with them for various purposes, resolves conflicting uses of the band, and receives and addresses reports of interference and requests for additional interference protection from incumbent (Tier-1) users.

Figure 2: The mechanism through which the SAS operates. Incumbent detection is achieved through a system of sensors known as an ESC (Environmental Sensing Capability) placed near Tier-1 installations. The CBSDs (Citizens Broadband Radio Service Devices) are all devices operating on the network. (Source: Wirelessinnovation.org)

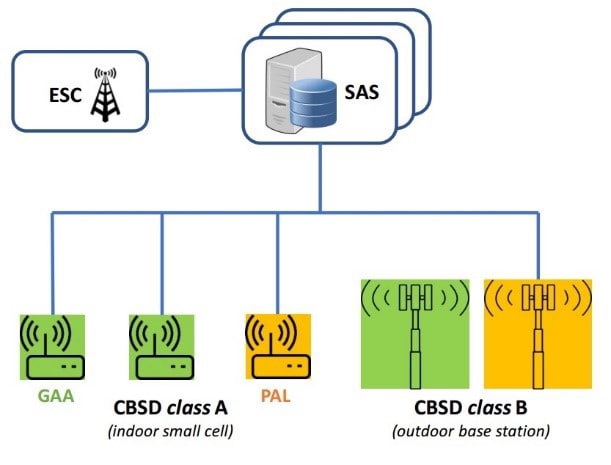

To protect the Tier-1 radars, satellite stations, and some grandfathered applications, sensors will be deployed near them to detect activity from other services on their frequencies. When this occurs, the sensors alert the SAS, which commands potentially interfering devices to change channels (Figure 3). PAL licenses will be auctioned within 100MHz (3550–3650MHz) of the 150MHz total. Each licensee gets a 10MHz channel in a single “census tract” for a renewable term of three years, and there can be no more than seven PALs in each area. GAA users can use any portion of the full 150MHz not assigned to the higher-tier users, free of charge.

Figure 3: The SAS is the “solver of all problems,” receiving an interference detection report from the ESC and commanding the CBSDs to change channels. There are CBSDs for indoor use (small cells, Class A) and for outdoor use (base stations, Class B) that are allowed much higher RF output levels. (Source: CBRS Alliance)

A census tract is typically a subdivision of a county that has a population ranging from 1,200 to 8,000 that the Census Bureau uses as a geographic unit of measure. As up to seven PALs may be assigned per census tract and there are more than 70,000 tracts, each PAL license is supposed to be reasonably affordable. PAL licensees are limited to use of 70MHz in any census tract, so the remaining 80MHz is available to GAA users.

Where CBRS Has Potential

There are many stated applications for which CBRS is well suited, and it’s likely that much more will appear as its full potential is more widely explored. One of the most interesting is the ability to create private LTE networks, which have previously been too costly for all but organizations with very deep pockets. With no alternatives, Wi-Fi is the technology currently used to create private networks. It is unencumbered by rules associated with licensed applications, and equipment is readily available, inexpensive, and fairly easy to deploy. However, it also has significant disadvantages when compared to commercial LTE wireless networks.

For example, as Wi-Fi operates on unlicensed frequencies in the Industrial, Scientific, and Medical (ISM) bands at 2.45 and 5GHz, it has much company, including Bluetooth and other low-power communication technologies. Even though each one has a mechanism designed to keep it from interfering with others, so many are in operation almost everywhere that interference is almost inevitable. Wi-Fi was also never intended to be used over more than small areas and has no hand-off capabilities at its core. When compared to cellular standards, Wi-Fi is less spectrally efficient and requires several times the base stations (access points in Wi-Fi terminology) to cover a given area as well.

Using CBRS however, a large company could create a secure private LTE network instead of Wi-Fi to run corporate-level or site-specific applications, using custom applications on employee mobile devices. A mining company could do the same to serve its management of other staff over a large geographical area. CBRS could also be used to provide in-building coverage for various facilities through a private network with specific customization such as enhanced security features. In short, CBRS makes it possible to create an affordable LTE private network without having to rely on a wireless carrier, at much lower cost, with far less complexity. The aspiring network owner would buy FCC-certified gear, register the equipment, and select an SAS vendor to configure the network.

For wireless carriers, CBRS offers capacity expansion without the complexity of sharing the band with Wi-Fi, and its 10MHz channels can be combined using CA to increase data rates. They could also use unlicensed GAA frequencies to transport signaling and data traffic. In both cases, network quality delivered by an LTE-based solution should be better than that of Wi-Fi. As cable operators have few spectrum holdings, CBRS may also allow them to enter the wireless industry by deploying LTE networks, effectively becoming Mobile Virtual Network Operators (MVNOs).

CBRS may also play a role in redefining how a Distributed Antenna System (DAS) is constructed and who owns it. A DAS is a technically and administratively difficult and costly to manage, often beyond the means of facility managers or other enterprises. CBRS could make this feasible in some facilities such as concert halls, sports arenas, theme parks, shopping malls, and hotels and conference centers. This may be appealing for a DAS operated by an entity other than a wireless carrier (called a neutral host). In this case, neutral hosts could own multiple private networks, aggregating their traffic and sending it outward to the Internet via traditional carriers.

A private LTE network might also serve as an IoT connectivity solution, as a competitor to wireless carriers and Low-Power Wide Area Network (LPWAN) operators to bring aggregated data from the “edge” where the data is gathered to the “outside world.” As IoT device networks are constructed, data from many wireless-enabled sensors is aggregated at a gateway and then sent outward via LPWANs or cellular networks to cloud data servers and then to the recipient (a corporate control center, for example).

In addition, if a GAA-type user installed small cells where the sensors are located, the CBRS would effectively become a private network using unlicensed spectrum that could be cost-competitive with other approaches and provide a significant level of security. These are just a few of the possibilities for which CBRS could be used, and more will surely be appearing soon.

But Will It Work?

As these are very early days for CBRS, there are many challenges that must be faced and overcome, and with the lure of potential revenue, they surely will be. As this is written, LTE modems supporting CBRS are few, of which Qualcomm’s Snapdragon X20 Gigabit LTE modem was the first, and a spectrum controller from Federated Wireless debuted around the same time. However, there appear to be a variety of components in development as well as radios from Nokia, and others.

Testing began on various elements of CBRS in the last half of 2016, and Nokia, Qualcomm, and Alphabet staged a demonstration in January at the Las Vegas Motor Speedway to show how CBRS can be used to deliver 360° 4K video streaming from inside the race cars traveling at high speed around the track. The video was streamed in real time using YouTube Live Events. In August, Verizon, Ericsson (now a part of Flex Power Modules), Qualcomm, and Federated Wireless demonstrated the first use of CBRS in an LTE Advanced Carrier Aggregation scenario.

Alphabet’s Access team has been involved with CBRS for years as a participant in the standards process, and earlier this year set up the Trusted Tester Citizens Broadband Radio Service Device program that allows qualified organizations to run self-service tests to ensure their base station equipment works with an SAS that Access has created.

So, there is no lack of enthusiasm, and the CBRS Alliance created by Ericsson, Federated Wireless, Intel, Nokia, Qualcomm, and Ruckus Wireless, now has more than 70 members including all four major U.S. wireless carriers. In addition to being the umbrella evangelist for CBRS, the alliance will establish a product certification program in the U.S. to ensure multi-vendor interoperability and compliance with FCC rules.

What To Expect In The Near Future

CBRS is rapidly advancing and will likely deploy in early 2018. For example, Lemko Corporation has developed a complete solution for creating an LTE private network that is claimed to be as simple to install as Wi-Fi. CBRS received much attention at Mobile World Congress Americas in September, from chipset vendors through small cells and solutions for specific applications as well as a variety of demonstrations. It’s likely that CBRS capability will be included in at least some smartphones introduced in 2018 as well as small cells and other system components, as chipsets will surely be available from the major vendors to support them. It’s also likely that Voice Over LTE (VoLTE) will be added eventually, expanding CBRS capabilities even further.

That said, although multiple demonstrations and trials have taken place, the real test will occur when an SAS has been in operation for some time, as it is the primary determinant of whether CBRS will succeed or fail. If it succeeds, the wireless landscape will have changed dramatically, and for the better. There will be more opportunities for entities other than the Big Four wireless carriers to provide private networks and other capabilities for the first time.